tax on venmo over 600

Third-party payment processors like Venmo PayPal and Cash App are now required to report a users business transaction to the IRS if they exceed 600 for the year. Rather small business owners independent.

New Tax Law Requires Cash Apps Report Transactions Of 600 To The Irs Venmo Paypal Zelle Apple Pay Youtube

This applies to those who have a business and are set up to accept payment cards or payments from a third-party settlement organization then you will receive a Form 1099-K.

. Theres a little bit of confusion over this Venmo rule says Steven Rosenthal senior fellow at the Urban-Brookings Tax Policy Center at the Urban Institute. Dont Believe The Hype Bidens 600 Tax Plan Wont Force You to Report All Venmo Transactions to the IRS. As of Jan.

The American Rescue Plan Act will change how some are taxed for receiving over 600 in third-party funds for online sales on sites like Etsy and eBay. As a small business owner or even if you just frequently uses cash apps you need to know the IRS rules. One Facebook post claimed any transaction on Venmo.

The IRS is coming after anyone who receives over 600 in payments for goods or services processed by third-party payment apps like Paypal or. If you receive 600 or more payments for goods and services through a third-party payment network such as Venmo or CashApp these payments will now be reported to the. As long as youre not making additional income over 600 via these apps you should be in the clear.

If you make 600 or. 1 the Internal Revenue Service IRS requires reporting of payment transactions via apps such as Venmo PayPal Stripe and Square for goods and services sold. The new tax reporting requirement will impact your 2022 tax return filed in 2023 Payments of 600 or more for goods and services through a third-party payment network such.

1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more. Starting the 2022 tax year the IRS will require reporting of payment transactions for goods and services sold that meets or exceeds 600 in a calendar year. The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal transactions over 600.

Anyone who receives at least. 1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more than 600 per year to the Internal Revenue. As of Jan.

Before the change taxpayers received a notification known as a 1099-K only if they processed more than 200 business transactions amounting to more than 20000 over a. January 19 2022 504 PM 2 min read. Business owners using sites like PayPal or Venmo now face a stricter tax-reporting minimum of 600 a year.

This does not mean that you will. Per last years American Rescue Plan Act so-called peer-to-peer payment platforms like Venmo or Paypal will now have to report any persons cumulative business. News Sports Things To.

PayPal Zelle Venmo Taxes. If your Venmo or CashApp transactions exceed 600 and qualify as taxable income you will likely be sent a 1099-K by the IRS to fill out. No Venmo isnt going to tax you if you receive more than 600.

What Your Business Needs To Know. According to FOX Business.

Venmo Paypal Must Report Your Side Hustle To The Irs If You Make More Than 600 A Year Abc7 Southwest Florida

Paypal And Venmo Taxes What You Need To Know About P2p Platforms Turbotax Tax Tips Videos

Mashable Maybe Don T Blindly Take The Advice Of Tiktok Finance Bros We Did A Little Debunking On That Viral Tiktok Telling You That You Ll Get Taxed On Large Cashapp Payments Hit

3 Top Tips Handling Irs 600 Venmo Cashapp Rule Business Tax Settlement

The Irs Will Start Collecting Taxes On Venmo Transactions Sparking A Surge Of Memes Know Your Meme

New Irs Tax Proposal Draws Mixed Emotions From Business Owners Financial Experts Wach

Will The Irs Track Every Venmo Transaction Fact Checking Financial Reporting Plans

Apps Now Required To Report Business Payments Exceeding 600 Annually

Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You

New Tax Law Venmo Cash App To Report Business Transactions Over 600 Wrvo Public Media

New Venmo Tax Law Are You Filing Correctly Behindthechair Com

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

Reporting 600 Cash App Transaction To The Irs New Tax Law Explained Answering Questions Youtube

Surprise Surprise Don T Say I Didn T Warn You R Wallstreetbets

Is The Irs Taxing Paypal Venmo Zelle Or Cash App Transactions Here S What You Need To Know

Henderson Yes The Irs Has Begun Snooping On Your Paypal Venmo Cash Apps Texasinsider Texasinsider Org

Snoop Reverses 600 Venmo Reporting Chicago Irs Tax Attorney

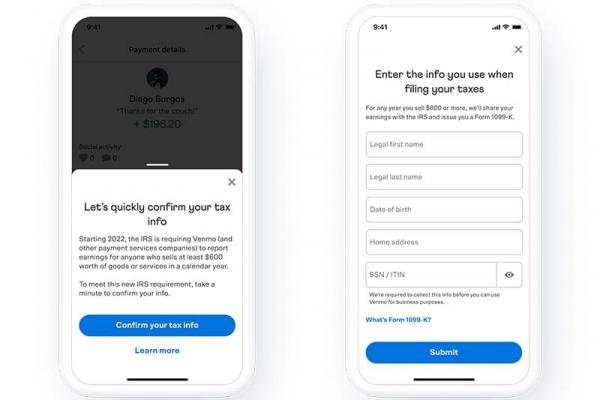

Press Release How To Confirm Your Tax Information To Accept Goods Services Payments On Venmo In 2022

Venmo On Twitter Got Questions About Venmo Amp Taxes Let S Break Down Which Payments Are And Aren T Affected By The 2022 Tax Changes For More Info Head To Https T Co Pwh2p15gl2 Https T Co Behbpcnsxj Twitter